Where your Contributions Go

There are numerous ways that you can make a contribution both to the Diocese to support clergy and the various diocesan support services or contributions to the parish to support the running of the church and parish office. We hope to set out here on this page an explanation of where your contribution goes, depending on which method you have used.

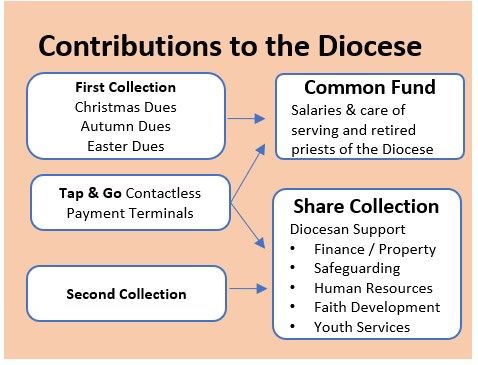

CONTRIBUTIONS TO THE DIOCESE

All contributions to the “first” and “second” collections (which are now placed in the collection boxes at the back of the church, along with the seasonal dues envelopes (Christmas, Autumn & Easter Dues) go directly to the Archdiocese. These contributions go to support the Clergy of the Diocese and the various Diocesan Support Services. See graphic overleaf for a more detailed explanation.

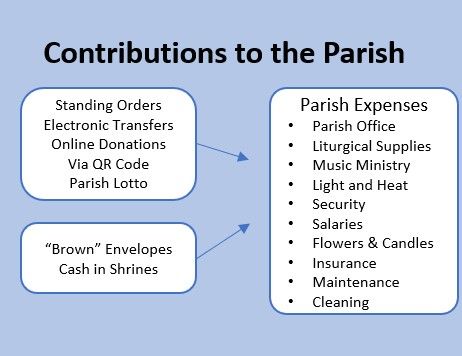

CONTRIBUTIONS TO THE PARISH

The only contributions that stay in the parish which enables us to cover the day-to-day expenses ( light, heat, insurance, parish office, liturgical supplies etc) are those contributions that are made by standing order, the brown envelopes in the church, family offering envelopes, the votive shrines, the parish lotto and once off gifts.

Once Off Donations

Once off Donations by Cheque, Cash or Electronic Transfer

You can contribute via a once off donation, be that a cheque, electronic transfer or a cash donation in one of the “brown” envelopes in the church. If using an envelope, please ensure you write your name and address on this so that we can aggregate your contributions over the course of the year for tax relief.

Standing Order

The best way for the parish is for you to contribute either by a standing order as this reduces administration making lodgements and facilitates projecting income month by month. It is also completely under your own control, via your online banking.

Parish Lotto

By participating in the parish lotto, you have the opportunity to win up to €5,000. Every week that the Lotto is not won, there is a weekly draw for a prize of €25. Approximately 53% of the lotto funds go to the parish, the balance covers the prize fund and administration fees. You can join the parish lotto by clicking here.

Leave a Legacy Gift in Your Will

Please consider how a gift in your will could help our Church meet the needs of future generations. We ask that you remember St. Patrick’s Parish when making your will. Your legacy will make a real difference to the needs of the Parish. Ensure your lifetime of faith, love and generosity lives on for generations to come

The parish as an eligible charity can claim tax relief on your donation, providing it is more than €250 annually. This means the parish can benefit some more from your generosity as a taxpayer without it costing you anything additional.

By way of example, a donation of €5 per week is €260 for the year. With the tax rebate (€116) this will be worth €376 to the parish. We can aggregate all your recorded contributions for the purpose of reaching an annual level.

Thus, a parishioner who contributes €5 per week to the Diocesan collections and a further €5 per week to the parish will be deemed to have contributed €10 per week or €520 per annum, and the tax rebate from both combined is €232 bringing the total contribution to the parish of €732. Contributions from Dues also count towards the annual total.

Please be aware that if you are making regular contributions via the envelopes, either for the Diocesan collections or to the parish, it is important that you write your name and address on the envelope so that we can identify your donation and aggregate them for annual tax relief purposes.

If you are eligible for the scheme’ which applies both to Self-Assessed and PAYE taxpayers and you have not completed the CHY 3 form in the last five years, the parish will forward one to you on request. You do not have to contact the Revenue Commissioners yourself.

GDPR

The personal information you provide is used by the parish to process the contribution in line with Revenue guidelines. It is not shared with any other person or organization. The information is kept only for as long as necessary and is then deleted from our systems as required by the European General Data Protection Regulation.